SPX Spotlight - Wednesday, Dec 18, 2024: Dramatic Market Sell-Off.

Fed signals fewer rate cuts, 10-year Treasury yield keeps rising, Bitcoin drops.

Introduction

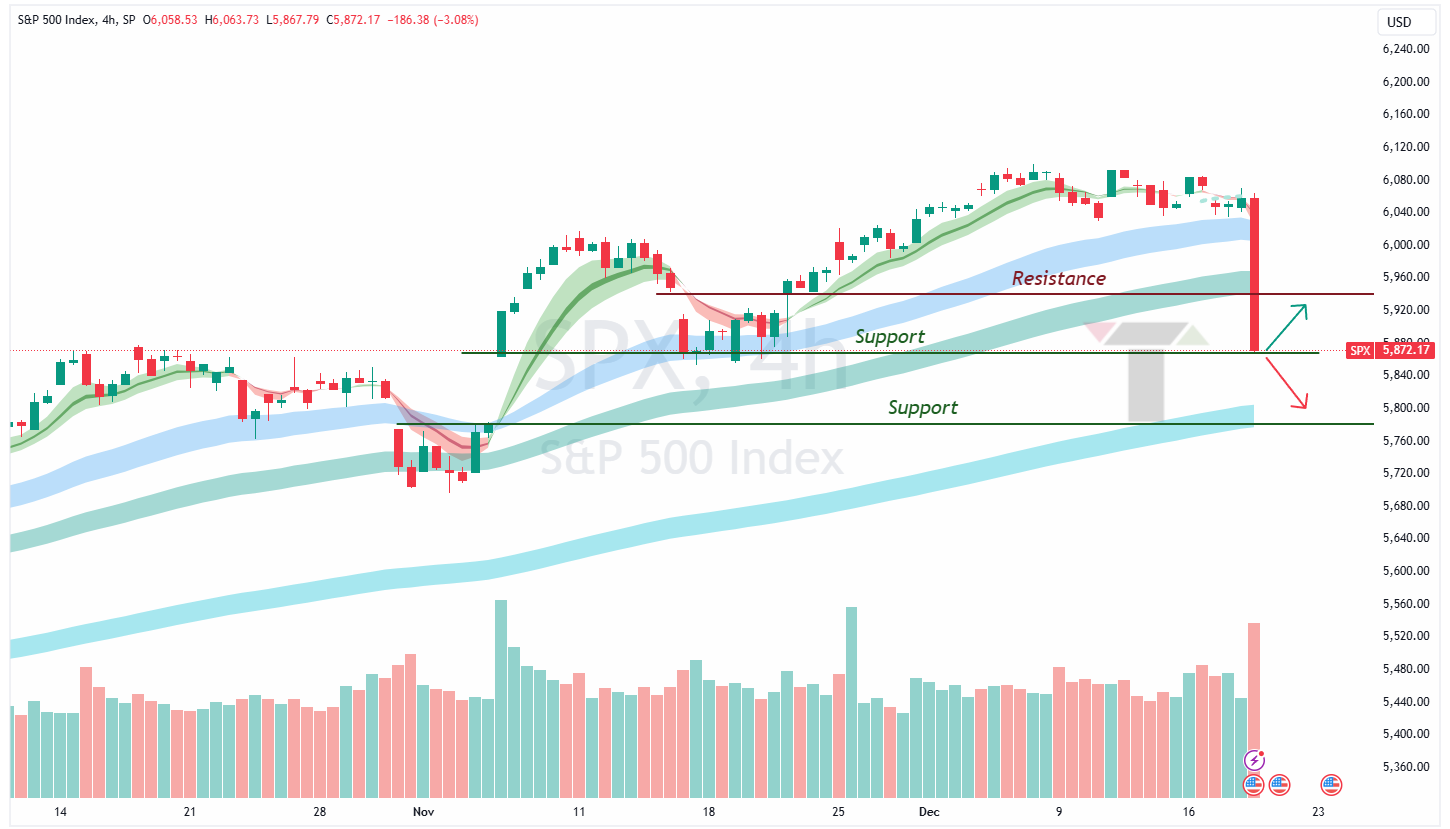

The S&P 500 (SPX) experienced a dramatic selloff on Wednesday, December 18, 2024, as the Federal Reserve's cautious stance on future rate cuts caught investors off guard. The index plunged 2.9%, closing at 5,872.16, marking its second-largest single-day loss of the year. This sharp decline has sent shockwaves through the financial markets, potentially signaling a significant shift in investor sentiment and market dynamics.

The Fed's decision to cut rates by 25 basis points was overshadowed by their projection of only two rate cuts for 2025, down from the four cuts previously anticipated. This more hawkish outlook has forced investors to recalibrate their expectations for monetary policy and economic growth in the coming year.

As we look ahead to tomorrow, December 19, 2024, market participants will be closely watching for any signs of stabilization or further selloff. The breach of key technical levels, particularly the psychologically important 6,000 mark, could trigger additional selling pressure. However, oversold conditions may also attract bargain hunters, potentially leading to a short-term bounce.

Market Drivers and Economic Reports

The Federal Reserve's decision to cut interest rates by 25 basis points was overshadowed by their revised projections for 2025, which significantly impacted market sentiment. Here's a more detailed look at the key market drivers and economic reports:

Federal Reserve Policy Shift

The Fed lowered its overnight borrowing rate to a target range of 4.25% to 4.5%, marking the third consecutive rate cut of 2024.

However, the central bank's updated "dot plot" revealed a more hawkish stance for 2025:

Officials now project only two quarter-point rate cuts in 2025, down from the four cuts anticipated in September.

The federal funds rate is expected to fall to 3.9% by the end of 2025, higher than the previous projection of 3.4%.

Out of 19 Fed officials, 14 indicated expectations of two or fewer quarter-point cuts in 2025.

Inflation Concerns

The Fed raised its inflation expectations slightly:

Forecasts for both headline and core inflation were adjusted upwards to 2.4% and 2.5% respectively, compared to September's 2.3% and 2.6%.

The core PCE deflator is now expected to reach 2% only by 2027, indicating persistent inflationary pressures.

Economic Growth Projections

Despite the cautious rate outlook, the Fed increased its projection for full-year economic growth:

GDP growth rate estimate for 2024 was raised to 2.5%, half a percentage point above the September forecast.

However, officials anticipate GDP growth to decelerate in subsequent years, aligning with the long-term projection of 1.8%.

Labor Market Outlook

The Fed's projections suggest a resilient labor market:

Most officials see the unemployment rate remaining steady at 4.2%-4.3% in 2025, near the current rate of 4.2%.

This indicates expectations of continued labor market strength despite the higher interest rate environment.

These factors collectively paint a picture of an economy that continues to show resilience, with inflation proving more persistent than previously anticipated. This has led the Fed to adopt a more cautious approach to rate cuts in 2025, significantly impacting market expectations and driving today's selloff in equities.

Technical Analysis

Recap

Today’s overreaction breaks a key level of 6,000 as discussed in previous reports. The aggressive sell-off leads to SPX sitting at 200 EMA and previous support on a 3 hour chart.

Bull/Bear Case

With such a extreme move in the index, it is difficult to gauge what would be the next move by market makers.

The bull thesis for tomorrow’s move is that we get a dead cat bounce to first resistance level at key EMA. The support and resistance levels marked form a great liquidity channel and we may see the index move in this range for a while before the it picks on a direction.

The bear thesis for tomorrow’s move is, we may continue the sell-off even lower to 5,800s. This would not only gap fill but also rest on 200 EMA.

Market Sentiment and Key Indicators

The volatility in the market is through the roof experiencing similar move to the one observe in August on Yen weakening the Dollar. The VIX will not encounter its first resistance until the 29-30 range.

Key Takeaways & What’s Next

The SPX's sharp 3% decline on December 18, 2024, marks a significant shift in market sentiment, primarily driven by the Federal Reserve's cautious stance on future rate cuts.

Watch for potential support around the 5,800 level for the SPX. A breach of this level could signal further downside potential.

Keep an eye on how different sectors react to this new environment. Technology and small-cap stocks were hit particularly hard in the recent selloff, and their performance could be indicative of broader market trends.

As we move into 2025, the market will be assessing the impact of the new administration's policies. The Fed has indicated it will only factor in these policies once implemented, which could lead to further adjustments in rate cut expectations.

Closing Thoughts

With the recent pullback, do you think we will have a Santa Rally?

What’s your take on market tomorrow? Comment below.