SPX Spotlight - Tuesday, Dec 10, 2024: Semis Sink, Inflation Ahead

The S&P 500 (SPX) stumbled for a second straight session on Tuesday, dragged down by semiconductor stocks, as jittery investors geared up for high-stakes inflation data.

Introduction

The S&P 500 experienced a nuanced trading session today, reflecting the market's collective holding of breath ahead of critical economic revelations. With Wednesday's inflation data looming like a potential market-moving thundercloud, investors displayed a mix of caution and calculated positioning, resulting in a measured pullback that speaks volumes about the current economic landscape.

Market Drivers

The SPX opened at 6,052.85, reached a high of 6,059.32, touched a low of 6,024.73, and closed at 6,034.91, down 0.3% for the day. Semiconductors experienced declines, with Oracle's disappointing earnings report weighing on market sentiment.

Oracle reported disappointing quarterly results, with earnings per share of $1.47 falling short of the expected $1.48. Revenue came in at $14.06 billion, missing the projected $14.1 billion. This earnings miss led to a significant stock decline, with shares dropping nearly 7% on Tuesday, marking the company's steepest daily loss in 2024

Google surges 5.6% as a result of optimism surrounding the recent unveiling of its quantum computing chip, Willow, which is anticipated to revolutionize computing capabilities.

Technical Analysis

Recap

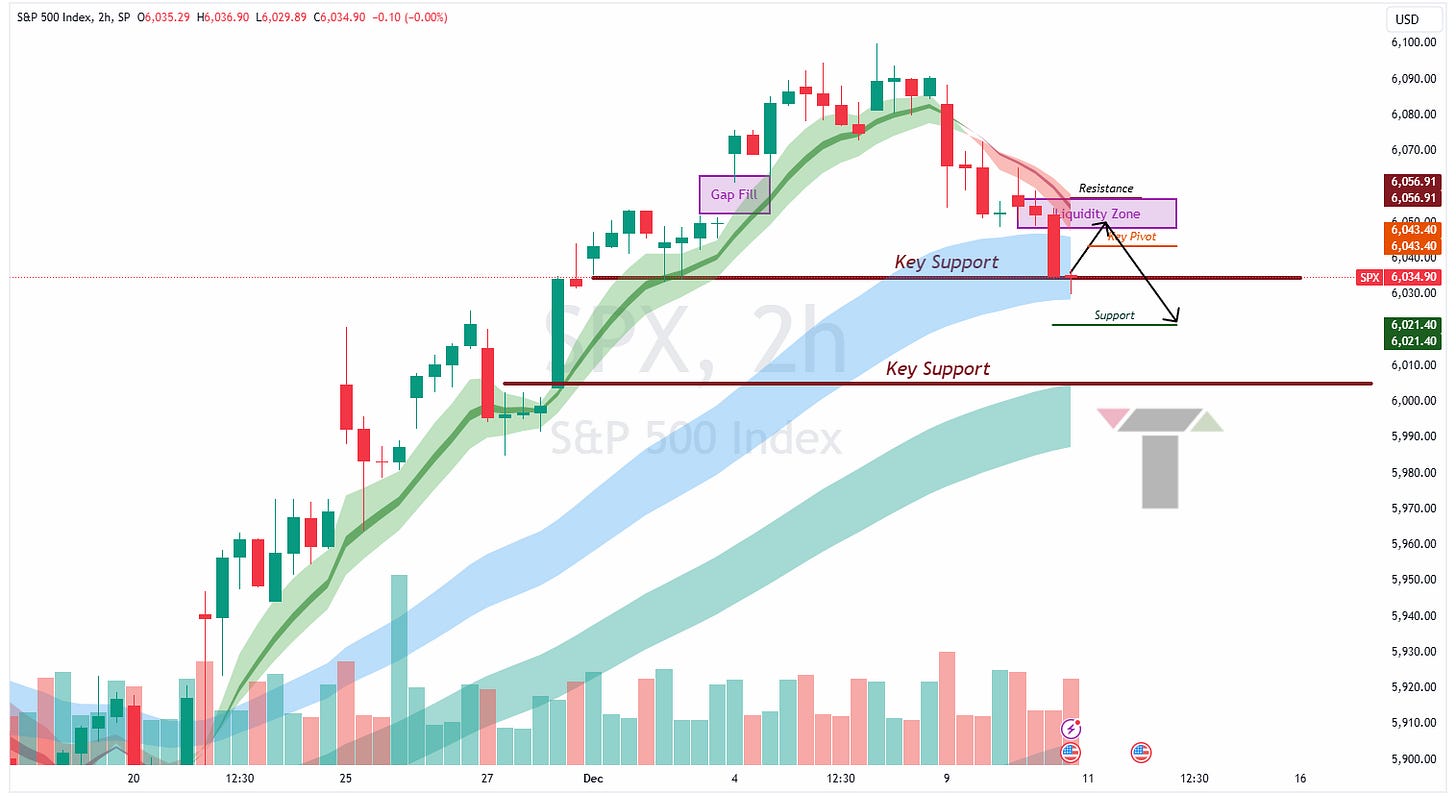

SPX ended up getting a strong pullback as expected, closing nearly at the support level. Depending on the inflation data, we might as well see a continuation of a down trend.

Bull Case

On the hourly chart, SPX broke the 50 EMA (blue ribbon) and closed as a key support. We may see an uptrend towards liquidity zone and meeting our first resistance towards uptrend at 6,057.

Bear Case

We may gap up to grab liquidity and sell off whole day meeting our first support at 6,021. At different time frames, we have several support levels that may help the index to avoid free fall.

6,000 - 6,005 is the key range to look out for if we sell off heavily over this week if not tomorrow.

Market Sentiment and Key Indicators

Today’s pullback might already be pricing in the inflation data.

Market might expect volatility on wednesday which may lead us to 14.80 range. Although, on hourly chart, VIX showed strong rejection of 200 EMA - 13.75 area still might be in play leading SPX to trend upwards.

Key Takeaways & What’s Next

SPX at pivotal point. Keys levels to watch out are 6,053 and 6,021.

Inflation data before market opens.

Crude Oil Inventories.

U.S. 10-Year Note Auction.

Adobe (ADBE) reports earnings tomorrow at close.

Closing Thoughts

Today's market action wasn't just about numbers, but about anticipation. The SPX's modest decline represents more than a simple price movement—it's a strategic pause, a collective breath-holding by investors parsing potential Federal Reserve policy implications. The 0.3% retreat signals a market at a delicate inflection point, where each economic data point could trigger significant portfolio realignments.

What’s your take on market tomorrow?