SPX Spotlight - Monday, Dec 9, 2024: Inflation data looms

The decline marked a pause in the index's recent rally. Concerns over potential economic implications and market volatility contributed to the cautious sentiment among traders.

Introduction

The S&P 500 (SPX) index retreated from its recent record highs on Monday, December 9, 2024. The index fell 37.42 points, or 0.6%, to close at 6,052.85. This decline came after the S&P 500 had reached its 57th all-time high of the year in the previous session.

Key Developments

Market Leaders Falter: A slide in market superstar Nvidia contributed significantly to pulling U.S. stock indexes down from their records.

Broad Market Decline: The retreat was not limited to the S&P 500. The Dow Jones Industrial Average fell 240.59 points, or 0.5%, to 44,401.93, while the Nasdaq composite dropped 0.6% from its own record high.

Sector Performance: The decline was broad-based, with most sectors experiencing losses.

Market Drivers

Nvidia Investigation: Reports surfaced that Chinese authorities are investigating the semiconductor giant Nvidia for possible antitrust violations, which likely contributed to the market's decline.

Global Developments: Despite the U.S. market's retreat, stocks in Hong Kong surged after senior Chinese officials endorsed a 'moderately loose' monetary approach.

Commodities Movement: Oil and gold prices increased following the removal of Syrian President Bashar Assad.

Despite today's setback, the S&P 500 remains up 26.9% year-to-date, reflecting the strong performance of U.S. equities in 2024

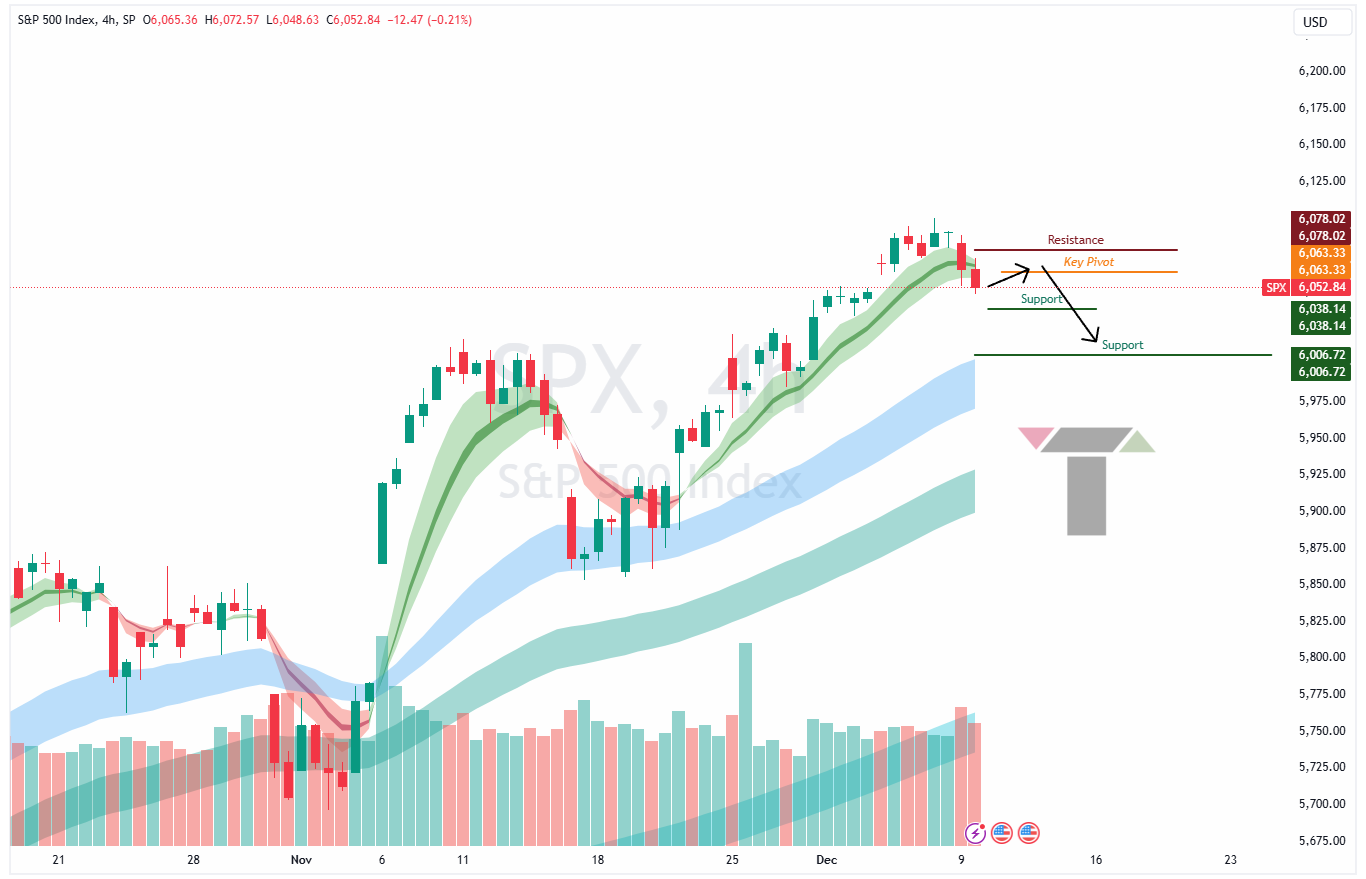

Technical Analysis

SPX broke the support early morning and began selling off throughout the day. Market was choppy mid-day creating a huge liquidity zone before making newer lows to end up filling the gap from a week ago and concluded a weaker close.

Bull Case

On the hourly chart, SPX has some support from 50 EMA (blue ribbon). The index may try to grab liquidity from 6,063 level and try to test 6,078 or even aiming to make newer highs. Although, the market may wait until inflation data to make that move.

Bear Case

Market may easily give up 50 EMA on hourly chart to test the support area around 6,038. On a larger time frame, there is enough room for the index to free fall till next key level of 6,006.

Market Sentiment and Key Indicators

Inflation Data: The market is anticipating significant inflation statistics to be released this week, which could influence expectations regarding the Federal Reserve's monetary policy.

Federal Reserve Meeting: There's an 85% probability of a quarter-point rate cut at the conclusion of the Fed's meeting on December 18.

Economic Optimism: Small-cap stocks outperform large caps, with the Russell 2000 Index gaining 11.0% compared to the S&P 500's 5.9% return, reflecting optimism about pro-business policies and economic growth.

Sector Performance: Cyclical sectors outperformed in November, with consumer discretionary, financials, and energy rallying on prospects of deregulation and increased M&A activity.

Monday’s market decline likely pushed the VIX higher hitting key EMA ribbon. We may retest the support and try to hit 14.80 level or even higher. This could lead the markets to make new lows of the week. If we break below 13.75, we are again in the run to make newer highs.

Key Takeaways & What’s Next

Watch for the SPX to find support above the 6,000 level. A rebound above 6,090 could signal a resumption of the uptrend.

The next major catalysts will be upcoming Inflation data on Dec 11, 2024 and Federal Reserve meeting and interest rate decision on Dec 18, 2024.

Closing Thoughts

With the market pulling back from record highs, do you think this is a healthy consolidation or the start of a larger correction? Share your thoughts in the comments!