SPX Spotlight - Monday, Feb 10, 2025: Can we hold the rally?

Steel stocks rally on Trump's tariffs.

Introduction

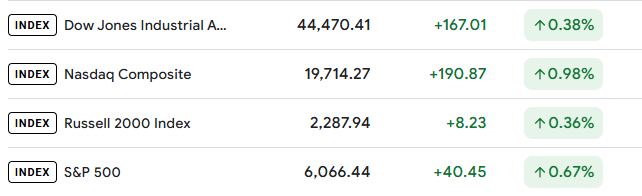

The S&P 500 climbed 0.67% to 6,066.44 on February 10, 2025, marking its seventh-highest close of the year as optimism around economic resilience and sector rotation fueled gains.

Market Drivers and Economic Reports

The S&P 500's performance on Monday was shaped by a mix of geopolitical developments, corporate earnings, and economic data releases. Here are the key drivers that influenced the market:

1. Tariff Announcements and Trade Policy

President Donald Trump announced plans to impose a blanket 25% tariff on all steel and aluminum imports, alongside reciprocal tariffs targeting nations that tax U.S. goods. Despite these threats, markets reacted calmly, with many investors interpreting the statements as part of ongoing trade negotiations. Stocks of U.S. steel producers like Cleveland-Cliffs ($CLF +15%), U.S. Steel ($X +12%), and Alcoa ($AA +9%) surged on expectations of domestic industry benefits.

2. Strong January Jobs Report

The U.S. labor market continued to show resilience, with the unemployment rate dipping to 4.0% (a new post-pandemic low) and wage growth accelerating to 4.1% year-over-year from December's 3.9%. This robust data tempered expectations for Federal Reserve rate cuts, pushing the anticipated timeline for the next cut to July/September 2025.

3. Corporate Earnings Boost

Corporate earnings provided additional momentum:

McDonald's reported a 4% rise in same-store sales despite missing profit estimates, lifting its stock by over 4%.

Nvidia led tech gains with a 3% rally as AI infrastructure stocks rebounded.

Monday.com soared over 25% after exceeding Wall Street's revenue and profit forecasts while unveiling plans to expand AI initiatives.

4. Sector Rotation and Oil Prices

Energy stocks outperformed as oil prices rebounded after a three-week decline, while technology stocks also posted strong gains driven by optimism around AI and semiconductor demand.

5. Bond Yields and Inflation Expectations

The 10-year Treasury yield rose slightly to 4.498%, reflecting tempered expectations for aggressive Fed easing amid strong labor market data. The New York Fed's inflation expectations survey showed no acceleration in short-term inflation outlooks, offering some reassurance to investors concerned about price pressures. Overall, Monday's market activity reflected investor resilience in the face of geopolitical uncertainty and optimism around corporate performance and economic strength.

Technical Analysis

Bull/Bear Case

Beautiful flag pattern forming with a strong range bound between 6,095 and 6,030. Those would be key levels to watch out for break or rejection to confirm the trends.

Key Takeaways & What’s Next

The S&P 500 continues to exhibit strong bullish momentum, closing at 6,066.44 on February 10, 2025, amid optimism about economic resilience and sector rotation. However, the market faces key levels and potential catalysts that could shape its trajectory in the coming days:

Key Levels to Watch:

Support: Immediate support lies at 6,044 (Monday's low), with a more critical level at 6,000, a psychologically significant threshold. A breach below 6,000 could signal a deeper pullback toward the 5,700 level, which previously acted as strong resistance.

Resistance: On the upside, the SPX must clear Monday’s high of 6,073 to target the January all-time high of 6,118.71. A breakout above this level could pave the way for a move toward the 6,200-6,250 range.

Upcoming Catalysts:

Fed Chair Powell Testifies: J. Powell testifying at 10 AM EST tomorrow morning on economic outlook.

Inflation Data: The January Consumer Price Index (CPI) report is due Wednesday and is expected to show a year-over-year increase of 2.9%. This data will provide crucial insights into inflationary pressures and their impact on Federal Reserve policy.

Geopolitical Developments: President Trump’s proposed tariffs on steel and aluminum imports could introduce volatility, particularly if reciprocal measures are announced midweek as expected.

Earnings Season: Continued earnings reports may influence sector-specific moves, with tech and consumer discretionary sectors remaining key drivers of market performance.

Closing Thoughts

Will J. Powell destroy the steady gains we have been observing in the market? Comment below your thoughts on where the markets are heading.