SPX Spotlight - Monday, Jan 27, 2025: China's AI Advances Rattle Markets

New models for DeepSeek changes OpenAI

Introduction

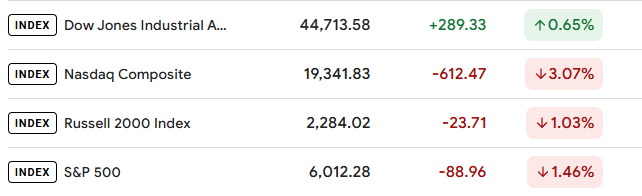

The S&P 500 (SPX) experienced a significant downturn today, closing at 6,012.28, down 1.5% amid concerns over China's progress in artificial intelligence. This sharp decline was primarily driven by a sell-off in technology stocks, particularly in the semiconductor sector.

Market Drivers and Economic Reports

Several key factors significantly impacted the market today, leading to a sharp downturn in tech stocks and the broader S&P 500:

Chinese AI Advancements: The release of an AI model by Chinese startup DeepSeek, which performs well against U.S. models (OpenAI, Gemini, Llama) at a lower cost, sparked concerns about U.S. competitiveness in the AI race. This development rattled investors and led to a sell-off in technology stocks, particularly in the semiconductor sector.

Tech Sector Vulnerability: The tech-heavy Nasdaq Composite experienced its worst day since 2020, falling 3.1%. This decline was largely driven by worries about the massive investments made by major U.S. technology companies in AI development and whether these investments will pay off in light of Chinese advancements.

Semiconductor Stock Plunge: Chipmaking giants like Nvidia and Broadcom saw their stocks drop by more than 11%, while the VanEck Semiconductor ETF (SMH) plummeted nearly 7%. This sector-wide decline reflects investor concerns about the future demand of hardware in AI.

Earnings Anticipation: The market's reaction was also influenced by the upcoming earnings reports from major tech companies. With Meta Platforms, Microsoft, Tesla, and Apple set to report later this week, investors are reassessing valuations in AI-related sectors.

Treasury Yields: The yield on the 10-year Treasury dropped to 4.55%, its lowest level in more than a month. This decline in yields typically indicates increased demand for safe-haven assets amid market uncertainty.

Geopolitical Tensions: President Trump's threat of emergency tariffs on imports from Colombia, although later rescinded, added to market jitters and highlighted ongoing geopolitical risks.

Technical Analysis

Recap

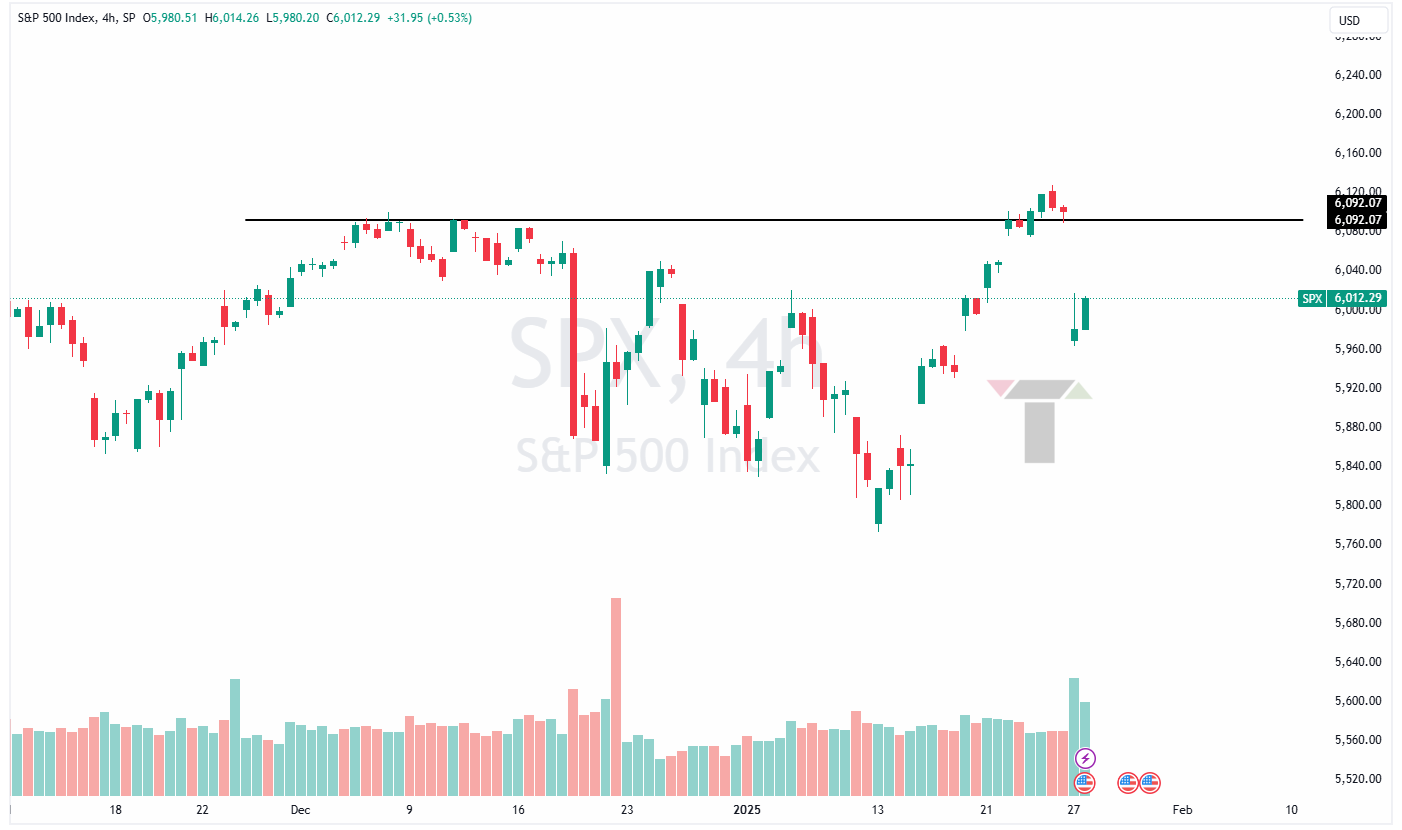

We briefly made a new high on Friday 24th session and saw a huge flush today on the Chinese AI news. A bit of recovery suggests it was a overreaction by the market and we have a gap to fill.

Bull/Bear Case

We bounced off key EMA levels and are still in a strong bullish trend. With earnings season in progress, we may see market chop off in this range for a while before break above or below.

6,035 marks a key resistance level (from longer timeframe) for market to test. Alternatively we may gap up to that level and sell off entire day before running into FOMC meeting on Wednesday.

If we give up the pivot level of 5,998, we may retest the consolidation level at 5,978.

Market Sentiment and Key Indicators

A classic expansion and contraction of volatility observed today. the volatility consolidation level still marks as a key level which could be re-tested again before making a move to 17.0 level.

It may take significant efforts for markets to close the gap and allow VIX to rest at 15.0 level.

Key Takeaways & What’s Next

The S&P 500 is currently navigating a complex market environment, with several key factors influencing its near-term trajectory:

Boeing and Starbucks few of the many names reporting earnings tomorrow.

Markets will closely scrutinize earnings reports from tech giants.

FOMC meeting on Wednesday could bring in volatility.

Durable Goods Orders report at 08:30 AM EST.

CB consumer confidence report at 10:00 AM EST.

Closing Thoughts

As the market digests this new competitive landscape in AI, will we see a prolonged correction in tech stocks, or is this a buying opportunity for long-term investors? Share your thoughts in the comments!