SPX Spotlight - Monday, Jan 13, 2025: Staged Comeback Amid Tech Selloff

Market exhibiting strong resilience; Six days before Trump takes office.

Introduction

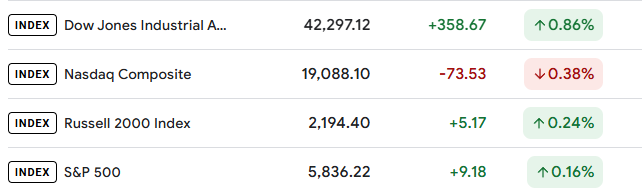

The S&P 500 defied early losses to close higher on Monday, ending at 5,836.22, up 0.16% despite a tech-driven selloff that weighed on the Nasdaq. This resilience in the face of rising Treasury yields and growing doubts about Federal Reserve rate cuts showcases the index's strength heading into a crucial week for economic data.

Market Drivers and Economic Reports

Stocks

Tech Sector Weakness: The Nasdaq closed lower as technology stocks faced selling pressure, partly due to rising Treasury yields. This sector rotation out of growth stocks impacted the broader market.

Defensive Sectors Outperform: Healthcare and energy sectors showed strength, helping to offset losses in technology and contributing to the S&P 500's slight gain.

Magnificent Seven Mixed Performance: While these stocks have been key drivers of market performance, their influence was mixed today. Some faced selling pressure, while others held up, reflecting the market's current uncertainty.

Small-Cap Underperformance: Small-cap stocks, as represented by the Russell 2000, have been underperforming due to concerns about higher borrowing costs. This trend continued today, highlighting the divergence between large and small-cap stocks.

Upcoming CPI Data

All eyes are on the Consumer Price Index (CPI) report scheduled for release on Wednesday, January 15, 2025.

This crucial inflation indicator could significantly impact market sentiment and Federal Reserve policy expectations. Investors are keenly awaiting this data to gauge the trajectory of inflation and its potential influence on future interest rate decisions.

Q4 Earnings Season Kickoff

The fourth quarter earnings season is set to begin, with major banks leading the charge. Wall Street analysts project an impressive 8% year-over-year increase in earnings per share (EPS) for the S&P 500 in Q4.

This optimistic outlook is further supported by Goldman Sachs strategists, who note that actual S&P 500 EPS growth has historically exceeded consensus forecasts by an average of 4 percentage points per quarter over the past 11 quarters.

Technical Analysis

Recap

As discussed in the previous article, we filled the gap from November 2024 and are back in the swing zone.

Bull/Bear Case

We filled the gap from november and had a strong close. This trend could follow up tomorrow where we could meet our first resistance at 5,867.

Alternatively, we could gap up to the resistance level pre-market and sell off for the rest of the gap retesting the lower trendline.

Market Sentiment and Key Indicators

We have PPI data coming in the morning that could elevate the volatility in the market. This could give an opportunity for VIX to retest the trendline before heading lower.

If the PPI numbers contribute to strong bearish sentiment, we may go back to the trendline and close in the 21 level range.

A close below the volatility consolidation level is important for the markets to rally upwards.

Key Takeaways & What’s Next

Inflation Data: All eyes are on Tuesday’s Producer Price Index (PPI) report and Wednesday's Consumer Price Index (CPI) report, which could significantly impact market direction. Economists anticipate the December CPI might show stalled progress on inflation, with potential increases in gas, food, vehicle, and shelter costs.

Earnings Season Kickoff: Major banks, including JPMorgan Chase, Goldman Sachs, and Bank of America, are set to report earnings this week. These results could provide insights into the financial sector's health and broader economic trends.

Fed Speakers: Several Federal Reserve officials are scheduled to speak before the blackout period ahead of the late-January meeting. Their comments could offer clues about the Fed's stance on future rate cuts.

Technical Levels: Watch for the S&P 500's ability to hold above the 5,820 level. A break above 5,850 could signal further upside potential.

Sector Rotation: The divergence between the S&P 500 and tech-heavy Nasdaq suggests a potential shift from growth to more defensive sectors. This trend may continue if inflation concerns persist.

Closing Thoughts

The next two weeks of January will experience volatility in the market due to various events. Watch out for PPI and CPI reports this week to help gauge market sentiments and direction.

Comment below your thoughts below on the Jan outlook.